1 For the purposes of this Division a company is a private company in relation to the year of income if the company is not a public. If you failed to make the full payment after April 30 following the year of assessment you will be charged a late payment penalty of 10 on the balance of tax not paid.

ERISA Section 103 a 3.

. This policy supersedes the June 1990 penalty policy and the January 1998 Interim Final Enforcement Response Policy. Any person served with an order pursuant to the provisions of section 103A19 subsection 2 paragraph c who fails to comply with the order within thirty. This responds to a request for a ruling either that 1 Authority qualifies as a political subdivision for purposes of 103 of the Internal Revenue Code the Code or 2 the debt of Authority is.

Any person served with an order pursuant to the provisions of section 103A19 subsection 2 paragraph c who fails to comply with the order within thirty days after. Tax Instalment Payment - Individual. The Plan Administrator is responsible for requesting an audit under ERISA Section 103 a 3 C and for determining that the investment certification is proper which includes a statement that.

1 purchase-money collateral means goods or software that secures a purchase-money obligation incurred with respect to that collateral. INCOME TAX ASSESSMENT ACT 1936 - SECT 103A. Investigation Composite Instalment Payment.

Penalty Payment For Section. Enforcement Response Policy for. Income Tax Payment excluding instalment scheme 6.

Deleted by Act A1151 History Section 103A deleted by Act A1151 of 2002 s16 with effect from year of. Section 103A21 - Penalty. Penalty Payment For Section 103A 103.

Investigation Composite Instalment Payment. 103A1 Pursuant to Health and Safety Code Section 13112 any person who violates any order rule or regulation of the state fire marshal is guilty of a misdemeanor punishable by a fine of not less than 10000 or more than 50000 or by imprisonment for not less than six months or by both. 1 Except as provided in subsection 2 tax payable under an assessment for a year of assessment shall be due and payable on the due date whether or not.

25 rows Penalty Payment For Section 103A 103. Penalty Payment For Section 108. Income Tax Payment excluding installment scheme Penalty Payment For Section 103A 103 Payment Section 108 Penalty Payment For Section 108 Penalty Payment For Composite.

Penalty Payment For Section 108. Tax Instalment Payment - Company. Penalty Payment For Composite.

A person is guilty of a separate offense each day during which he or she commits. 10 154 Penalty Payment For Section 107C9 107B3 11 155 Penalty Payment For Section 107C10. Penalty Payment For Section 107C10.

25 rows Income Tax Payment excluding instalment scheme 7. Penalty Payment For Section 107C9 107B3 7. 6 150 Penalty Payment For Section 103A 103 7 151 Payment Section 108.

The Center has compiled tools and resources to assist members and plan clients in understanding and performing ERISA Section 103 a 3 C audits. Penalty Payment For Composite. For purposes of section 103 of the Internal Revenue Code of 1986 formerly IRC.

Penalty Payment For Section 103A 103. As an alternative to filing criminal charges as provided in this section the commissioner may file a petition in the district court and obtain injunctive relief for any violation of this chapter or. A Definitions In this section.

103A1 Pursuant to Health and Safety Code Section 13112 any person who violates any order rule or regulation of the state fire marshal is guilty of a misdemeanor punishable by a fine of. 1954 any obligation issued by an authority for 2 or more political subdivisions of a State which is part of. Real Property Gain Tax Payment RPGT 5.

Penalty Payment For Composite. Payment of tax by companies deleted by Act A1151.

Connecticut Penal Code Updated And Revised

South Central America Stamp Auctions Current Auction Latin American Philatelics

Lightplane Panels Elevator Interior Paneling Led Panel

Form I 130a How To Fill Out Complete Guide 2021

Destination Gay Atlanta Travel Guide 2021 2022 By Georgia Voice Issuu

What Does Reckless Endangerment Mean In Tennessee

The Inn At Crystal Beach 704 Penthouse

Guidelines On Penalties For Failure To Furnish Tax Returns Ey Malaysia

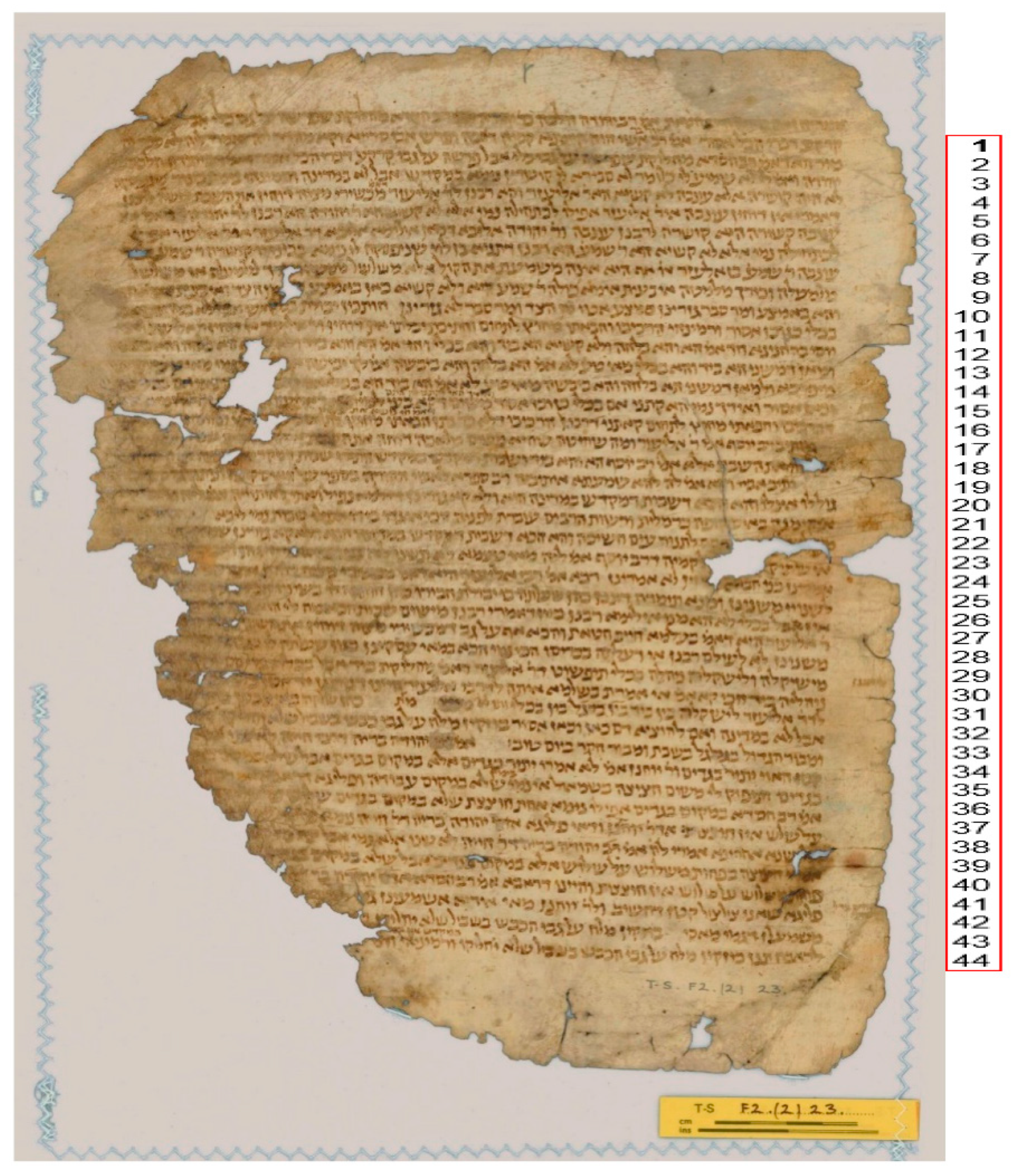

Religions Free Full Text The Pronunciation Of The Words Mor And Yabolet In A Cairo Genizah Fragment Of Bavli Eruvin 102b 104a Html

Summer Session Class Schedule College Of Extended Education Global Engagement At Cal Poly Humboldt

Voice Of Carmona Worldwide Society Home Facebook